Five Top Dividend Stocks to Earn Income While you Invest

I know that investing may seem like you just put money aside that you can’t use until years from now, when the money hopefully grows. But did you know that some companies will pay you while you invest in them? Investing in dividend stocks can be a good way to earn income while also investing in generally lower-risk stocks.

Dividends are cash payments some companies make to their investors, usually once a quarter. Dividends are a company’s way of re-distributing their earnings and cash back to their investors.

Dividend stocks are quite often boring stocks. With a few exceptions, the highest yielding dividend stocks are ones I’ve never heard of (think iron miners, real estate trusts). That’s because exciting, growth stocks don’t usually pay high dividends. Growth stocks (think earlier stage companies like Facebook) either make negative income, or need to use their cash to invest in the company’s growth. More stable stocks, and ones sitting on large cash piles, tend to be the ones that can distribute their cash out to shareholders.

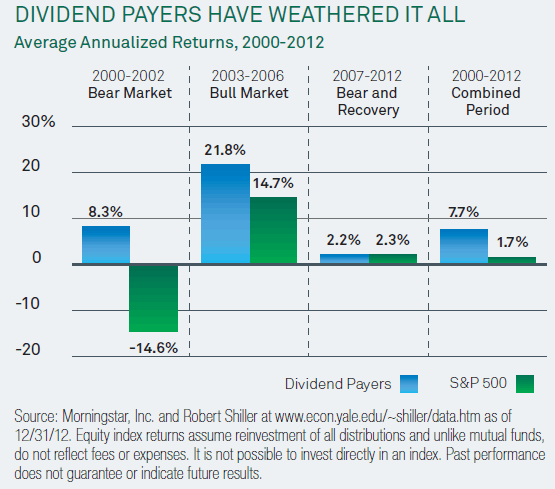

While dividend stocks can have lower returns than growth stocks, because they are past the high growth point of their company’s’ life cycle, they tend to provide solid returns over the long term. According to a BlackRock study, dividend paying stocks have out-performed those which don’t pay dividends over time, while also offering lower volatility.

When it comes to picking a dividend stock, you don’t just want to blindly pick the stocks with the highest dividend yields. In fact, if the dividend yield is too high, it could indicate that the company is paying dividends it can’t afford or that it is not growing at all.

Take Whiting USA (WHX) trust as an example. The company has a 82% dividend yield rate (its annual dividend is equal to 82% of its current stock price), which in theory is fantastic. But if you read the fine print, it turns out that WHX is a trust set up by Whiting Petroleum. The trust got 90% of the net proceeds from a sale of a set amount of oil, which it will pay out as dividends.

The trick is, once all the dividends are paid out, the trust expires worthless (which management estimates will occur in March 2015). So if you bought the stock today, at $2.65 per share, you wouldn’t receive enough dividends to even cover your purchase price before the trust expires.

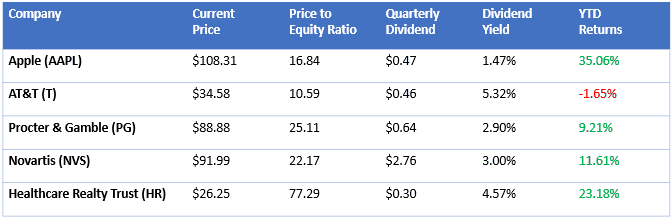

The key is to find stocks that offer both dividends and solid future growth. Ideally this company would also raise dividends as its performance grows. Here are some stocks that may be worth considering in that category:

You might be wondering why Apple is on there. Yes, Apple’s dividend yield is not huge compared to many other stocks. But Apple has a history of increasing dividends, and I believe it will continue to increase dividends in the future as it distributes a chunk of its mountain of cash back to investors. Not to mention, it has Carl Icahn breathing down its neck to do so.

It’s also important to note that while dividend stocks can offer great benefits, such as income while investing, they also have their downsides. Dividend stocks tend to outperform the market during more volatile periods or downturns. When the market is surging, they might not have as big of an upside as growth oriented companies. So if you’re looking for stocks that will provide short, big bursts, those generally aren’t stocks paying dividends. But if you want generally steady returns over a long period of time, dividend stocks may be worth considering.

From a tax perspective, ordinary dividends are taxed at the same rate as your income. This is unlike long-term capital gains taxes (for gains on stocks held for more than a year), which are taxed at the current capital gains rate of up to 15% (certain qualified dividends on the other hand are taxed at the capital gains rate too). So the higher tax may be a consideration for you as well, depending on your tax bracket.

You should do you own additional research to make sure you are comfortable before investing in the dividend stocks I shared. There are other great stocks paying high dividends that I did not include, so consider this list a starting point if you decide you would like to add dividend stocks to your portfolio.