STRATEGIES TO MANAGE STOCK MARKET VOLATILITY

2016 has not been a good year in the market so far (thanks, China). The opening week of 2016 was Wall Street’s worst opening week ever, with prices continuing to decline this week. You might be wondering: what’s an average investor supposed to do in response to this stock market volatility?

In a lot of ways, this is similar to the drop we saw in August, when fears over the Chinese economy caused a correction in the US stock market (the first 10%-plus drop in four years). And my number one piece of general advice is going to be the same as it was back then (as it was the last two times we saw market drops before that): don’t panic, and don’t sell.

You need to remember, the stock market is a long-term game. What happens to your portfolio in the next few months doesn’t matter nearly as much as what happens in the next decade.

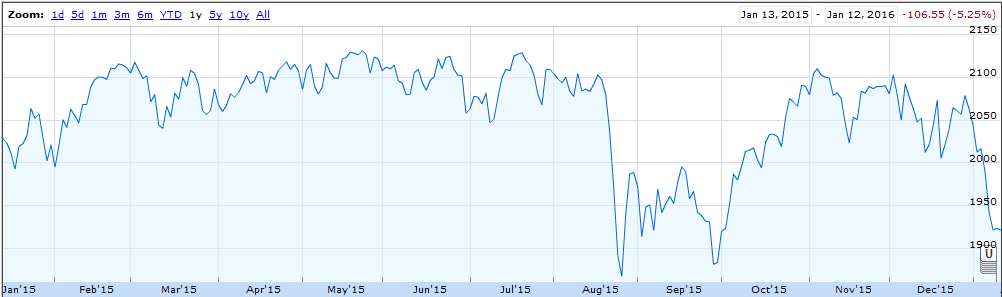

Check out this chart of the S&P 500 index over the past year. Looks pretty scary, right?

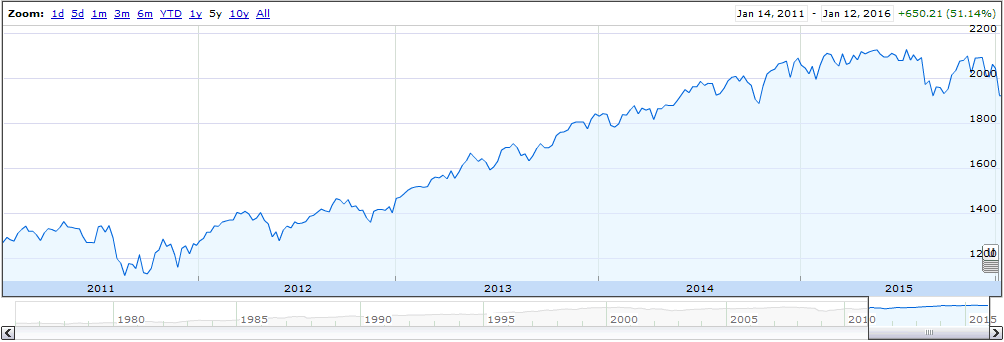

But if you zoom out to a 5 year view, the picture looks a lot rosier. In fact, I’d be celebrating today’s share prices if I’d heard about them back in 2011.

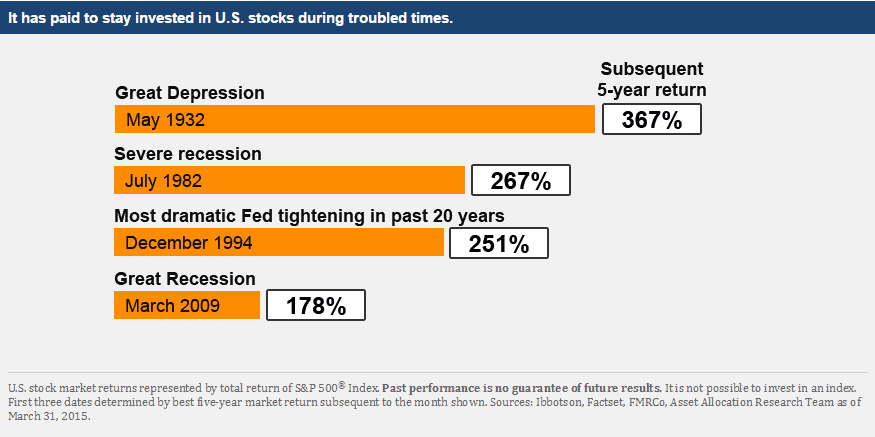

That’s because over time, stocks tend to go up. In fact, some of the greatest gains happened right after big dips.

Whatever you do now, you should not sell off your portfolio. You’d be much worse off missing a big market rebound than you would be riding out a choppy market for a year.

(Note, that advice assumes you all have long time horizons to stay invested. If you need money in the next year my advice might be different).

If the idea of passively waiting out the current market volatility horrifies you, there are a few strategies you can use to guard your portfolio:

- Hedge with a short position

If most of your money is invested in long positions (i.e. you bought shares), you can hedge your downside risk by adding some short positions on the market. For example, you could sell short shares of an ETF that tracks a market index (like SPY).

A short position means that you are selling shares now, and plan to buy them back later at a lower price. That means that you make money when the share prices drop. A short position on the market is a hedge for your portfolio because you will make money in your short position while your long positions decline in value. This does mean that you limit your upside though, as you would lose money on your short position if the market improves.

- Earn income by selling covered calls

A call option is the right to buy a share of stock at a certain price (the strike price). You pay for the right to this option with a premium. For example, you could buy a call option on Apple (AAPL) from Charlie for $5 at a strike price of $100. If you then exercise your right, Charlie has to sell you a share of Apple for $100, regardless of what it’s trading for in the market. You would exercise this option if Apple starts to trade above $100 per share. If you buy the call option, you want the stock price to go up.

If you are selling the call option, you’re Charlie. You collect the $5 now, knowing you may need to sell someone a share of stock for less than you it’s worth in the future. You want the stock price to go down, because that means you can keep the $5 premium without ever having to sell any stock.

If you sell a covered call, you’re selling call options on shares of stock that you already own. That means you don’t have to risk losing money on the shares by buying them for $105 in the open market and selling them for $100 to the option holder.

Does that make sense?

If you believe stock prices are going down, covered calls can be a nice strategy. While you sit on stocks and wait for values to go back up, you’ll collect income via option premiums. And there isn’t a huge risk if stock prices do increase, because you already own the shares you’d have to sell to the option buyer.

- Look for bargains

Market dips can represent great buying opportunities. If there is a stock you are interested in from a value perspective, you may consider buying it now. You may not get in at the bottom price, but if you are looking to hold a stock long term, purchasing it at the lowest possible price doesn’t really matter.

The key is to stick with stocks that have strong fundamentals (solid cash reserves, a low P/E ratio, a dividend). I’ll be publishing posts with bargain buying opportunities soon. It looks like prices may continue to fall in the next few weeks though, so I wouldn’t feel a need to rush into any purchases.

But whatever you do, don’t panic.