New To Trading? Make Sure to Avoid These Mistakes

Statistics say that 9 out of 10 traders won’t make any profits from their efforts, they might even have some losses. When numbers like these are working against you, you need to be ready to commit and prepare better than others if you want to survive as a trader. When you think about this, it makes sense – how can you gauge your progression, if you have no idea what to expect? And, even though luck might be on your side once or twice, it won’t get you out of every problem.

Before you jump into the trading world with good capital level, you need to fully comprehend what you’re getting into. Read up on trading, research what you’ll probably invest in. Study from personal finance financial blogs, make sure you understand all the aspects and be certain you’re ready to trade.

If you’re still certain that you want to go forward with this route after you do all the due diligence, choose a strategy and open a demo account. That way you’ll be able to try trading but without risking all of your capital.

Of course, every first time trader will run into some roadblocks, but if you read up on mistakes people most often make, you’ll be able to avoid making them.

These are some of the biggest mistakes traders tend to make:

Profit, profit, profit

Focusing on profit and nothing more can be a huge mistake because this way you can let some smaller details slip through the cracks. Sure, you’re trading to make money, but you can’t make a profit if you don’t trade successfully. Basically, if you’re already planning on how to spend the money you still didn’t make, you’re not really committed. Becoming successful takes a lot of time and constant learning, so you can’t just focus on profit.

Trying to trade before grasping the basics

Before you jump into this, get as much help as you possibly can. Consult professionals, read blogs, watch videos, ask for advice… You see, if you decided to go all in with all of your cash, you can’t read charts, you don’t know how markets differ, and you believe trading is a lottery – you’ll part with your money very soon. This is how financial disasters happen. You shouldn’t risk your seed money on something that has no real chance to work out. First, prepare, and then jump.

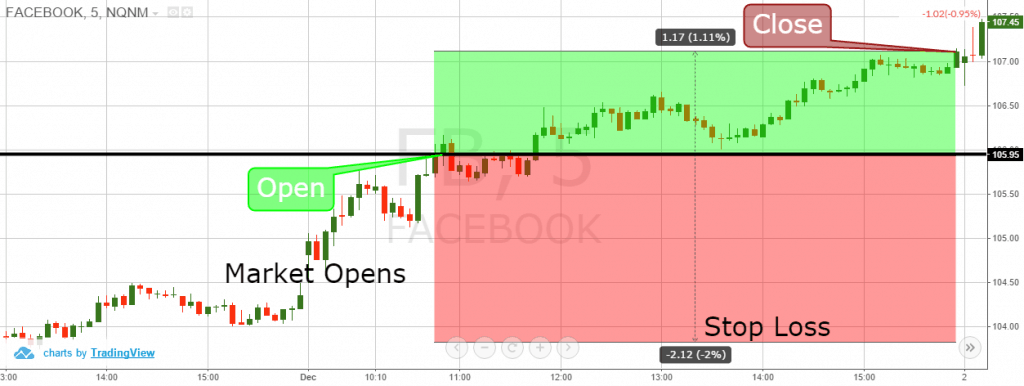

Not planning to have losses

Newbie traders somehow came to believe that trading is a way to earn a lot, and earn it without much effort. The biggest problem here lies in the fact that they also believe that trading comes without inherent risks. And that is so incredibly far from the truth that we can’t even start to explain. If you chose to try earning money trading because of a recommendation from a colleague or a friend, do the research before you jump all in. If you don’t have a loss management plan in place before you start trading, you’ll most probably end your trading career before it has a chance to get off the ground.

Not managing the money properly

If you are rash by nature, trading might not be the best calling for you. When you have a lack of control over your emotions it usually leads to improper money management. In trading that is something that quickly culminates in serious consequences. Consequences that will make you lose a lot and lose quickly. Before this happens, make a plan that will outline how much you can afford to lose. Never risk loss you can’t afford.

In the end, deciding to become a trader might be the best decision you made. But it won’t be so unless you prepare yourself and understand everything well enough.